Recently, our CEO Andrej Bolkovic had the privilege of sitting down with William J. (Bill) Brodsky for a fireside chat on the genesis of OCC, the evolution of the options market, and advice they have for mid-career and senior professionals. OCC holds deep respect for Bill as one of the most influential figures in the options industry, and his experience provided an invaluable perspective on navigating decades of transformation, including his time at the American Stock Exchange (AMEX, now part of the NYSE), to leading the Chicago Mercantile Exchange (now CME Group) as CEO for 15 years, to serving as Chairman of the Chicago Board Options Exchange (now Cboe Global Markets) for 20 years.

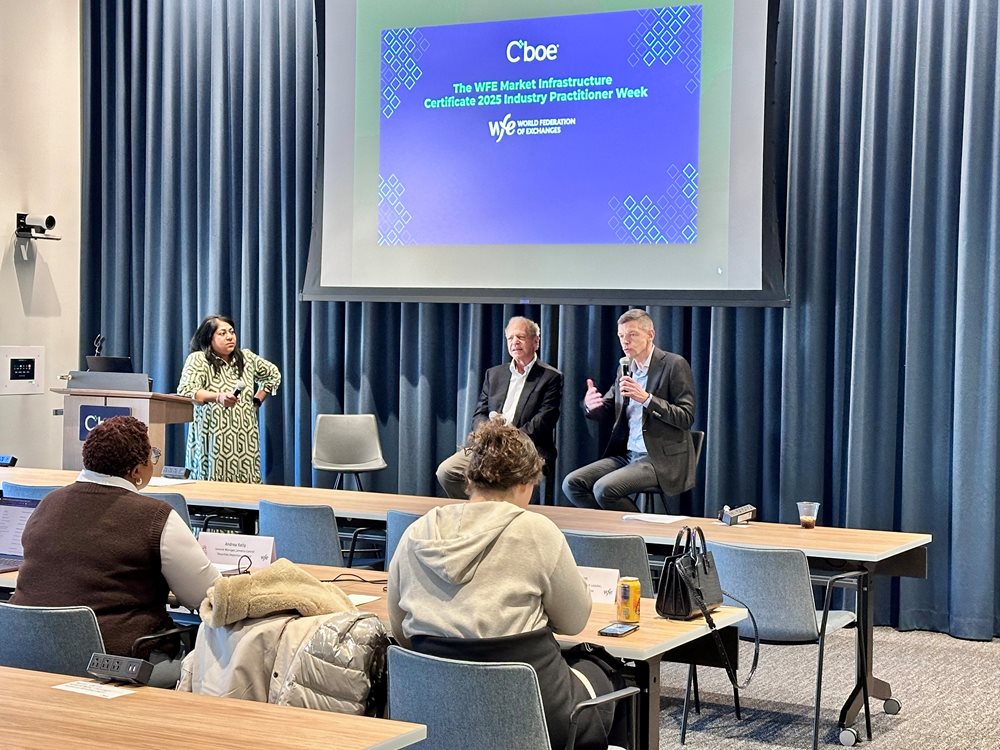

The fireside chat, moderated by Nandini Sukumar, CEO at The World Federation of Exchanges, took place as part of WFE’s Market Infrastructure Certificate program, which is built to serve the learning needs of senior managers and mid-career professionals in the trading industry.

To start off, Bill shared how he began his career as “a young lawyer on Wall Street” at a securities firm. After writing an article about options for a securities magazine (at his wife’s suggestion), he became more involved in the industry and was put in charge of the options business at the American Stock Exchange; while at AMEX, he also served as one of OCC’s earliest board members from 1975 until 1982 when he left to run the Chicago Mercantile Exchange.

Similarly, Andrej shared how he started out as a software developer at ING Bank in Europe. He worked on the brokerage system before gradually transitioning into more business focused positions and eventually CIO/COO roles.

“I worked for a long while at ABN Amro Clearing…and [they] sent me to the U.S., where I came to this beautiful city. What was supposed to be a three-year stint turned into four, then five…I’ve been in Chicago over 9 years now.”

Andrej came to OCC in 2023 after spending nearly two years as CEO at a proprietary market-making firm. After sharing his career journey, he described his typical day at OCC and how much attention is paid to managing risk as well as keeping up with market events, both intraday and day-to-day.

Drawing from their decades of experience in the industry, both leaders shared advice to the nearly 40 students of the program on how to navigate constant change, how to decide which strategic paths and products to pursue, and how to lead an organization through transformation.

In particular, Andrej shared some data about the options industry that illustrate how far it has come over the years, including how nearly all of the top 50 trading days by contract volume occurred in 2025. “Just two weeks ago, we recorded a new all-time record in terms of cleared options contracts: 110 million. We’ve seen a shift in terms of market participation, in terms of volumes, so we have to adjust from a technology perspective: how we manage intraday risk and how we manage zero-day risk exposure.”

He also alluded to how aspects of the decentralized finance space, such as continuous trading and tokenized assets, are starting to influence the “traditional” markets. OCC’s most recent white paper on continuous trading shares our detailed perspective on this topic.

Bill agreed that the industry is constantly evolving. He said, “My thesis in the business is, ‘the only constant is change.’ And when you’re living through it, you might not feel that, but if you look back and see how much has changed over the years, it’s truly incredible. When you talk about volume, I remember the first day [of trading] that the CBOE traded only 911 contracts.”

Andrej and Bill also discussed the importance of investor education. Bill said, “There’s a tremendous need for education of customers about these marvelous products, if they’re used properly. And the growth of the options business…is largely related to how people are trained and educated on how to use them…You can’t tie a profit & loss line to that, but if you do it well, the business will continue to grow.”

Following up, Andrej agreed and emphasized the work that The Options Industry Council is doing to make sure investors of all skill levels have high quality education: “The education part is still something that’s very much top of mind and something that we very much care about, making sure that people are educated on the risk that they take and also the benefits of the products that get introduced.”

The audience asked several questions about leadership and strategic vision, including how both Bill and Andrej go about deciding which opportunities to pursue when there is a wealth of choices.

Andrej said, “I can think of many situations where we had plans to invest in certain things, and some of them played out and some of them didn’t. Unfortunately, that’s the situation for most companies…There’s never one single goal or one source of decision-making that will guarantee you a particular outcome, but you do have to make those best educated guesses in terms of, what’s the opportunity, is the market ready for it, and…do I have interest [from the industry]?”

Bill followed up with the importance of having a foundational strategy to help guide your decision-making: “You can’t do everything with the same amount of energy. Even today, I’m not running a big company anymore, but I wake up and say, ‘What are the three things I want to do today?’ Because you can’t do everything…Pick the things that are most important and do them well.”

Another audience member asked about financial literacy education, including how much is enough and how to go about reaching Gen Z. Speaking passionately, Bill described how he has approached teaching summer interns at his son’s asset management firm. “We meet once a week over lunch, and I have a little syllabus I’ve made up of the basics… asset classes, stocks, bonds, cash, alternatives. You gotta build the building with a good foundation…In this country, for example, we have gone much more to self-directed individual retirement plans…who explains how to pick what the investment choices are? The importance of compounding returns? …It is very hard. You need a person who believes in it and can teach others about it.”

At the end of the discussion, Andrej and Bill shared their final thoughts with the audience.

“You’re in a great place,” Andrej said. “There’s lots of things that you can do as the markets evolve, and lots of challenges that you will tackle along the way, but that’s what makes this industry so exciting and this work so rewarding.”

Bill agreed, adding, “What I like about the industry most is it’s made up of very smart people, but it’s very fast changing. You have to constantly know what’s going on and figure out how that affects your business. So, befriend the smart people and keep in touch. No one lives in an isolated situation.”